Spring season is sports season in Hamilton County and this week's sports section is chock full of sports news from around the county—everything from golf to baseball to soccer to track! Check out this week's print or e-edition for the full spectrum of spring sports.Nonprofit organizations across…

Spring season is sports season in Hamilton County and this week's sports section is chock full of sports news from around the county—everything from golf to baseball to soccer to track! Check out this week's print or e-edition for the full spectrum of spring sports.

News

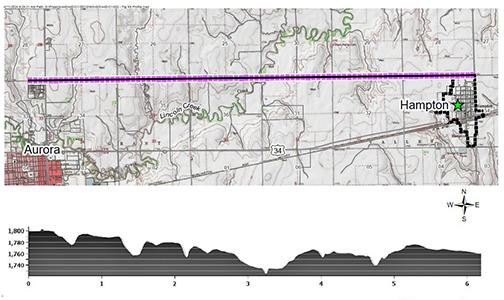

After being presented by its engineer with several possible scenarios for solving its ongoing water issues, the Village of Hampton is investigating the…

A conditional use permit (CUP) for MFC Construction of Aurora, that was previously given the green light by the county’s Joint Planning and Zoning Commission,…

The Giltner School Board met with Nebraska State Patrol Captain Dean Riedel Monday night to discuss the board’s concern over the state patrol’s drug spot…

Ag Life

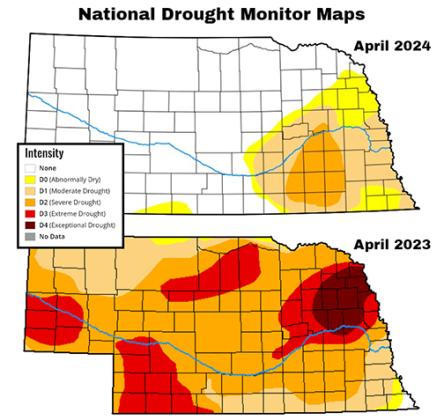

“We aren’t out of the woods by any means on the drought. We’re better, but we’re just sort of hanging in there right now.”So says National Weather Service (NWS…

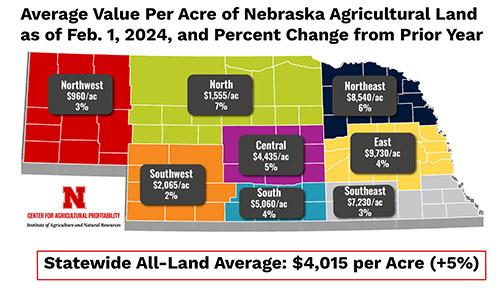

The market value of agricultural land in Nebraska is up in 2024, however, the state’s farm income is projected to fall this year, according to recent articles…

When farmers first began to till the Nebraska sod more than 150 years ago, a horse and plow were considered essential equipment. Then it was a gas-powered…

Sports

News Staff

The 100 meter dash final at last week’s High Plains Invite featured a lot of local flavor.Of the eight lanes, four of them were occupied by area ANR athletes…

News Staff

Lucas Gautier took a big step forward Thursday towards one of his goals of chasing the 800 meter run school record.The Aurora senior cut through the breeze to…

News Staff

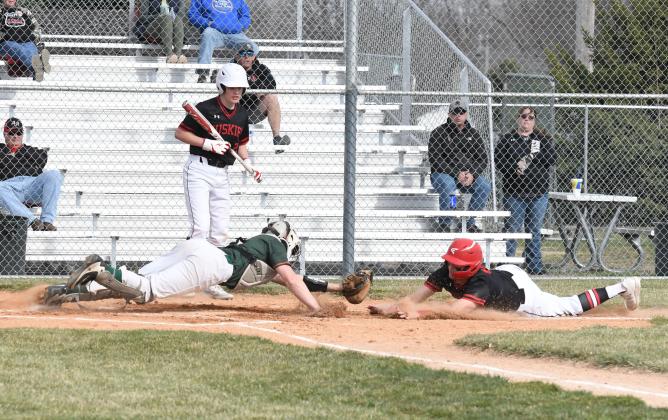

The first one is sometimes the hardest one to come by. Aurora’s baseball team doesn’t need to fret about that anymore.The Huskies earned its first win in…